Roughly 190 active fintech startups that I am aware of are based in the Greater Boston area, the geography of which runs in my view approximately from Portland in the north to Providence in the south, and west to the Connecticut River. This is down only slightly from last year despite some extensive pruning of the list. While it became clear that more than the usual number of startups had shut down (two that will be missed are MainVest and Surround Insurance), new fintechs continue to be founded.

What does it mean for a firm to be based in Greater Boston? Determining where a startup is headquartered is increasingly a judgement call. Some firms consider more than one place home. I exclude subsidiaries of fintechs with headquarters elsewhere, and I do reach out to companies for clarification when I have questions.

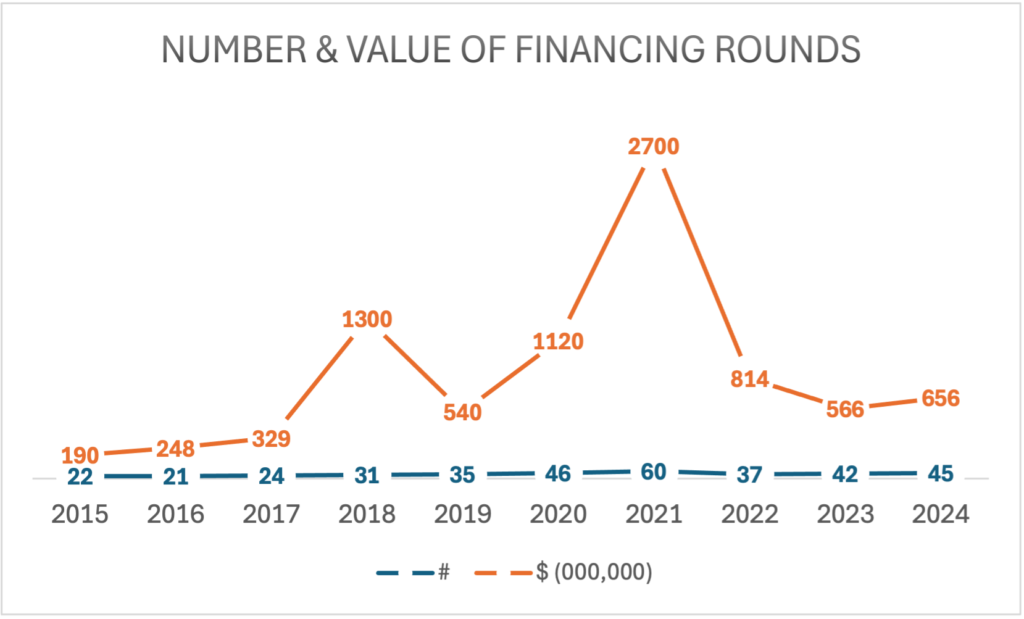

By my count, 45 of Greater Boston’s fintech startups raised, collectively, $656 million in equity last year. Does 2024 represent a recovery? Let’s just say it represents an improvement over the prior year, and I’m encouraged by the number of local fintechs successfully raising capital. An oddity in 2024 was that half a dozen firms raised capital without revealing the dollar amount. Here are the numbers:

| Devoted Health | $ 112,000,000 |

| FundGuard | $ 100,000,000 |

| Digital Onboarding | $ 58,000,000 |

| Gradiant A.I. | $ 56,000,000 |

| Overjet | $ 53,200,000 |

| Posh Development | $ 45,000,000 |

| Resurety | $ 32,000,000 |

| Indico Data Solutions | $ 19,000,000 |

| Ledgebrook | $ 17,000,000 |

| Aidentified | $ 12,500,000 |

| Claim Digital Assets | $ 12,000,000 |

| Herald | $ 12,000,000 |

| Databento | $ 10,000,000 |

| Clasp | $ 10,000,000 |

| PredictAP | $ 9,800,000 |

| PaymentWorks | $ 9,605,000 |

| Zengines | $ 9,000,000 |

| FiVerity | $ 8,511,985 |

| Marstone | $ 8,000,000 |

| EnFi | $ 7,500,000 |

| LearnLux | $ 7,100,000 |

| Conduit Financial | $ 6,000,000 |

| RemotePass | $ 5,500,000 |

| Kappa Pay | $ 5,000,000 |

| Datalign Advisory | $ 4,000,000 |

| Monit | $ 3,600,000 |

| Givzey | $ 2,700,000 |

| CapShift | $ 2,700,000 |

| Edge | $ 2,700,000 |

| FutureMoney | $ 2,500,000 |

| CargoMetrics Technologies | $ 2,500,000 |

| Almond Fintech | $ 2,000,000 |

| Light Frame | $ 1,700,000 |

| FiSpoke | $ 1,500,001 |

| Acceleron Bank | $ 1,401,252 |

| Wallit | $ 1,375,000 |

| BlueBean | $ 1,300,000 |

| Micronotes | $ 899,000 |

| Paerpay | $ 700,000 |

| Physis Investment | $ – |

| Energetic Capital | $ – |

| Penny Finance | $ – |

| Numerated | $ – |

| Willow | $ – |

| GiveCard | $ – |

There were no Greater Boston fintech IPOs in ’24, for the second year in a row, and no SPAC deals, for which retail investors can be grateful.

Quite a few of our fintech startups were acquired last year. It was the most active year for M&A that I can recall. Terms were undisclosed unless a price is noted. In some cases, terms may be revealed later.

- Ametros was acquired by Webster Bank.

- Cake was purchased by Foundation Partners Group.

- Circa was acquired by Stake for $9.5 million.

- DocFox was acquired by nCino for $75 million.

- LifeYield was bought by SEI.

- Numerated was acquired by Moody’s.

- Paytronix Systems was bought by The Access Group.

- Raise Green was acquired by Honeycomb Credit.

A couple of fintech firms founded and nurtured here decamped for browner pastures.

- USDC issuer Circle filed for an IPO in January, announced a move to New York City in September, and fired more than 5% of its employees in December.

- Bookkeeping startup Botkeeper moved to Florida in search of — one can only assume — porous limestone and restrictions on library books.

My sources of data include, in order of authority: Edgar, reputable publications, CrunchBase, disreputable publications, rumor, speculation, and LinkedIn. I no longer look at Twitter (or X, if you prefer) for funding announcements or for proof that a startup is still alive. Many older fintech firms have stopped posting there and many newer ones never started.

I am certain to have missed some funding events and exits and to be unaware of some stealthy startups. Please reach out if you know something I’ve missed or see something I’ve gotten wrong.

# # #