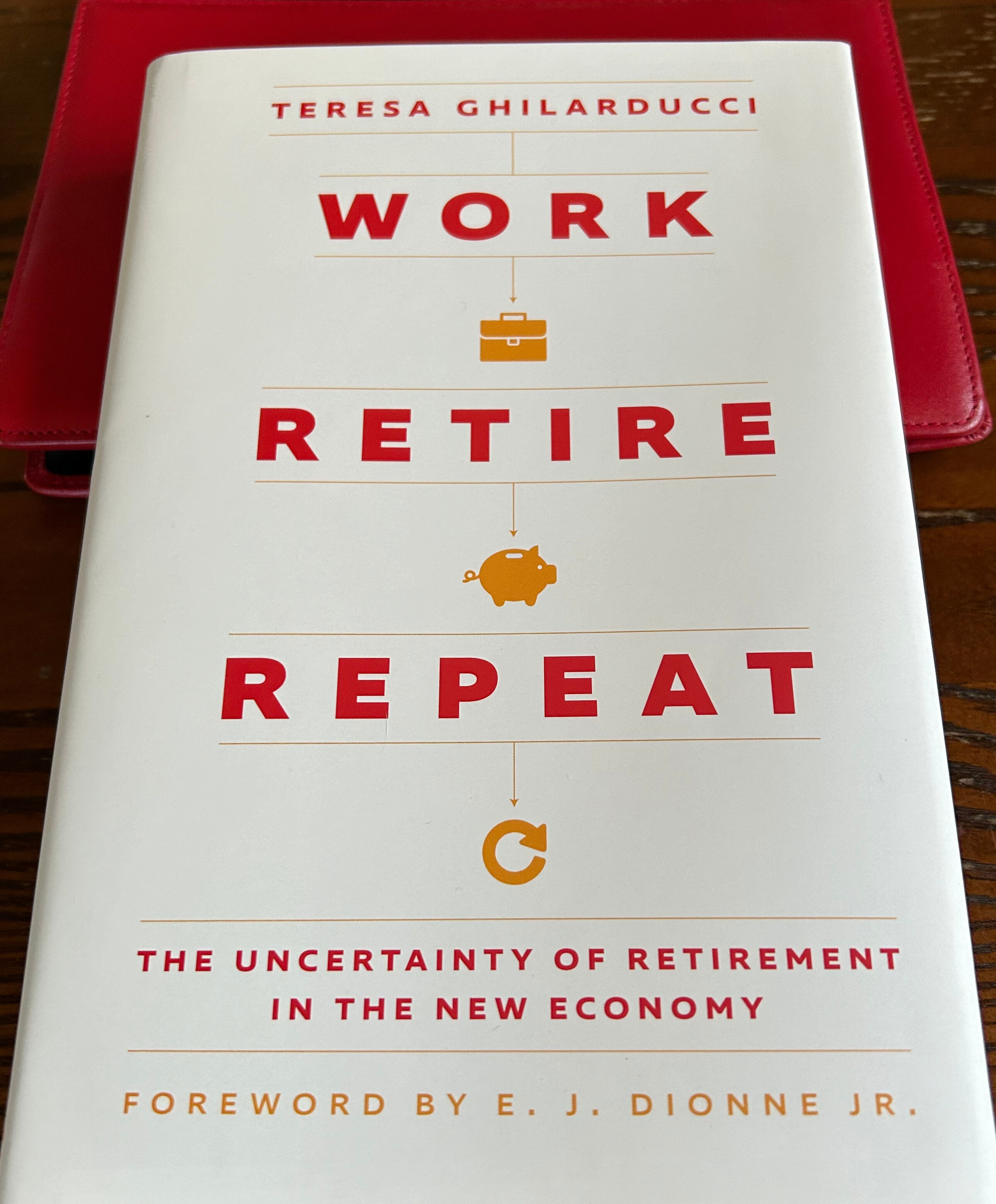

Part one of our interview with Professor of Economics Teresa Ghilarducci, on the topic of her new book “Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy,” is here.

Q. Teresa, I’d like to ask a few questions about making defined contribution plans fit for purpose.

A. One of my most downloaded papers for about 15 years was a paper that asked if 401(k) plans could be more like DB plans and solve our retirement crisis. I was earnestly, in my 30s, eager to take this experiment and make it a hybrid experiment. I wrote a book about hybrids, which were cash-balance plans, multi-employer plans like the Teamsters have and construction workers have. Those were highly successful. You have janitors, you have laborers, roofers, gig workers who go from construction site to construction site building things. Lady garment workers, truckers. People you wouldn’t think would be endowed with lifetime pensions because they don’t have a steady employer. But they were able to create these hybrid defined contribution plans where the employer decided to put in money and they had a life-time benefit. I find that intriguing. I love that.

For 15 years I mined that idea with great optimism. And we got Secure 2.1, we got Secure 2.0, we got the life insurance companies all involved in putting annuities into 401(k)s. And they all don’t work. The annuities in the 401(k)s have a moral hazard and an adverse selection problem. And the premiums are too high, anyway. These are really expensive, not very good products inside of a 401(k). And basically the 401(k) system had not spread to most of the workforce. The 401(k), in the optimistic eyes of Ted Benna back in the 1980s, were supposed to spread like wildfire, but it just didn’t happen.

Let’s call the experiment ended. We’ve learned some valuable lessons and we have to boldly go forward with more universal, professionally managed plans that provide lifetime income.

Q. Does that take us to GRAs?

A. Someone has said that GRAs have lived in the metaverse under different guises, but Teresa Ghilarducci is always behind them. The latest and best version of the Guaranteed Retirement Account is the Retirement Savings for Americans Act (“RSAA”).

Q. Who would manage the pooled investments? Who would handle the recordkeeping? Is it the government? The private sector?

A. It would be outsourced, just as New York, California, and the UAW do it. All entities that provide a trust fund for their workers’ retirement have that trust fund managed in a fiduciary way for the sole benefit of the beneficiaries by private investors. There are some that brought some of their investment functions in house, like the Texas Teachers, but the bulk of the money is managed by private investors who have the expertise and the scale.

Q. If these accounts are going to be managed like pensions and endowments, you’re going to pay institutional prices (not retail, which is what 401(k) account holders pay) — a good thing. But, if there’s going to be an allocation to private equity, to venture capital, and to hedge funds, how do you deliver top tier returns from these asset classes without resorting to the 2 and 20 fees structure?

A. Some managers are better than others and you need to make sure those alternative investments don’t fleece the retirees. I would say that the UAW trust fund for retiree health, where I was a trustee, did very well in making sure we got the best pricing. The PBGC got those fees down considerably. The Pennsylvania Teachers plan is on the other end of the spectrum. They seem to not scrutinize those fees at all. It depends on the quality of your trustees and the scale of your enterprise.

Q. How does the principal guarantee work? Doesn’t paying for a principal guarantee reduce the net investment return?

A. This book, Rescuing Retirement, which I wrote with Tony James, the former president of Blackstone, contains the GRA plan, which subsequently morphed into the RSAA. Larry Summers and I got into the programming. It turns out that if you guarantee the principal, it doesn’t cost anything at all. If you guarantee a 5% return, it costs a whole lot. But guaranteeing the principal costs practically nothing and it’s worth it, because very low-income people are risk averse and they’ll willingly pay for it.

Q. What happens to existing DC and DB plans if the RSAA is passed?

A. When I was young and idealistic, I thought we should scrap the 401(k) system and just have a plan like they have in the Netherlands, or in some other imagined America where things were done more efficiently. But now that I’ve lived in the world for a couple of decades and understand America has its own way and that there are institutions that are built around this system, the Retirement Savings for Americans Act is probably the best compromise we’re going to get. That is a system where we keep the existing benefits for all workers who have a retirement plan. I certainly don’t think we need to make it more liberal like Secure 2.0 did, which extended the mandatory distribution age to 72. I thought that was a wet kiss to the rich and to their children. It made no public policy sense at all. So I’d be on the vanguard of stopping those little give-aways.

But mainly I’m for more government money being spent to have all workers have a retirement account which should be sweet music to the right wing because I’m in favor of all workers becoming capitalists. But I’m in favor of all workers’ plans being managed the way the rich manage their plans — professionally, and without having to make withdrawals whenever there’s an emergency. The rich don’t take money from their retirement plans whenever there’s a muffler that needs to be fixed but the poor do. We need to protect that money from mufflers.

Q. With this plan everyone will have to participate. Many low-income workers (and many others) don’t participate in voluntary retirement plans because they simply can’t afford it. How, then, will they be able to afford to participate in a mandatory RSAA account?

A. It turns out that when you give lower-income workers a trusted way to save for their retirement, they always vote in favor of it. I have spent my life studying the employee benefits of low-income people, and when low-income people are in unions and have a voice in how they want their wage dollars spent, they almost always put it into healthcare and pensions.

The American people, even those earning low wages, when they have a chance, they put a substantial amount of money into their retirements. And I can cite chapter and verse. But shorthand: Teamsters, warehouse workers, janitors, the very lowest paid construction workers, auto workers, steel workers, mine workers — they put a huge amount of their compensation towards their economic security.

We’ve asked workers if they would pay more for mandatory savings or would they rather keep the money but raise the retirement age or lower Social Security benefits so they get more cash now. Time and time again they say no, make me save for my retirement.

To further prove that point, I did an ethnographic study with an anthropologist when I was at Notre Dame, and we interviewed Latino low-income women about what type of retirement security best fit them, and they said no more money in my 401(k). My family makes me take money out to buy a house, to get them out of jail, to have a quinceañera party. This cash I have in my 401(k) is my family’s money. Put more money in Social Security or put more money in a pension I can’t touch.

Q. Would the self-employed need to pay both employer and employee contributions to the Retirement Savings for Americans Act account?

A. Yes. Under the RSAA, gig workers, temporary workers, contingent workers, and consultants would put in 5%. If your reported income is below the median, you would get a 3% government match to your 5% contribution. If you aren’t in that income category, you wouldn’t get the match. You would get defaulted in to a TSP-like program.

That would be invested by a firm like Blackrock or Fidelity. You don’t get the world but you get three super-big, low-fee passive funds. Your juices to buy Gamestop would have to be satisfied someplace else. And you could opt out because we’re in America. No other decent plan has you opt out before retirement but in America everyone says you have to be able to do that. It doesn’t make any sense to economists.

Q. When people take money out, they would do so by annuitizing. What would that look like? Who would manage the annuity and how do you get the fees on that really, really low?

A. The answer to the question is scale. The RSAA is sponsored by Hickenlooper and Tillis in the Senate, and by a Democrat and a Republican in the House, so it’s a bi-partisan, bi-cameral bill. How it is annuitized would be up to the appointed board. It would be up to the board to market the annuity and make it the default option. And with that scale, you could get a low fee.

Q. Researchers have found that income from an annuity makes people who are retired happier than having an equivalent lump sum they must make last a lifetime. That feels like a finding from the ZIRP years. How did annuity owners feel about their set payments when inflation spiked?

A. The evidence that you’re citing — I know those papers well. We’ve reproduced some of those results but we just haven’t published them.

It’s true over inflationary periods and non-inflationary periods. The pathway to that result comes about from the health effects. Literally the cortisol level effects and the self-reporting of anxiety and depression.

What happens is that people with equally valuable pension plans are compared. You have some with a lifetime income from a defined benefit plan based on a balance of $250,000, and someone with $250,000 available in a lump sum from a DC plan. And you control for everything else: pre-retirement health, race, sex. And then you compare their objective well-being and their cortisol levels, and you find that people with a lump sum they need to manage for the rest of their lives have higher stress levels and higher levels of anxiety and depression.

That’s what we mean by better off. And the DB plan, even if it’s not inflation indexed, still has that absolute number being the same. People feel that they can control things, perhaps by eating lentils. They feel they have some control over how to deal with generalized inflation, but they don’t have any control over what happens to the financial markets.

Managing money is hard enough, but when you get into your 70s and 80s, when cognitive decline is most likely to set in, even paying your bills becomes more difficult, and to do complex financial planning is beyond the scope of most humans.

Q. Home equity is a significant asset many retirees will have but it’s highly illiquid. Do you have thoughts on reverse mortgages or other programs to help people convert home equity into retirement income?

A. It’s something I’ve been thinking about quite a bit. I just gave a talk at the American Economic Association on a new paper (I’ve just received the page proofs) called Where Do Workers Get their Wealth. I looked at working class households (so the bottom 90%) for the past 40 years. I looked at what has happened to their real wealth. It’s gone down in every category, including home equity, when you adjust for inflation. My conclusion is that the debt creating institutions have overwhelmed the wealth creating institutions. For every tax dollar we put into retirement savings, Citibank has put marketing dollars behind their credit card. For every dollar we put into mortgage deductions, the banks and brokerage community have put money behind no-down-payment products and home equity loans.

People are coming into retirement with twice as much mortgage debt as they used to. The average amount of home equity for a retiree is about $100,000, so a reverse mortgage doesn’t do much for them. The best solution for this is a really good product that is now being considered by the California State Legislature. There are a lot of working-class people in California who are sitting in a $1.3 million 3/2 in some kind of suburb. The proposal is for the state of California to own it, and to give them a lifetime annuity.

That’s one idea. Another idea is that we get rid of zoning laws and let multifamily housing be built at the end of the block. People want to age in place but not in that crappy 3/2. They want to age in place in a modern, no-upkeep condo. Right now there aren’t enough condos for older people so they’re stuck in their homes.

Reverse mortgages are very limited. You have to have a lot of equity, and since they’re not group reverse mortgages, they’re too expensive.

Q. In whose interests is it for members of Gen X, GenY, and Gen Z to believe Social Security won’t be there for them when they retire?

A. The financial industry has always started its retirement planning discussion with one sentence. “We’re here today because you know that Social Security may not be there when you retire.” It’s part of the marketing pitch to instill a belief that Social Security won’t be there when you retire.

It’s very much in the financial interest of brokers and financial planners for people to believe that they have to save on their own. But that’s short-sighted financial planners. Good financial planners, honest financial planners, say “Social Security will be there when you retire, but it won’t be enough to achieve the lifestyle you want.”

Life insurance companies opposed Social Security for the first year of its existence in 1935, and a bunch of senators promised that they would reverse Social Security in the next year (1936) if the life insurance companies found that people fled their annuity products because of this new program. But the life insurance companies said no. They said it was the best thing that ever happened to the annuity business because for the first time a broad share of the population felt like they actually could retire and so would need a supplement. We also found that with union pension plans. All of a sudden, Social Security, as we say in academia, “grew in” a demand for a comfortable retirement.

So, I think the financial services companies are trying to market their businesses based on the belief there will be no Social Security, but in fact if they were enlightened, they would realize they should support Social Security because it’s a complement to their products.

Q. You’ve stated that, “Never ever ever will Social Security be eliminated.” Yet, George Bush, Ron DeSantis, and Mike Pence all suggested full or partial privatization of Social Security, and Rick Scott would like to “sunset” it. Nikki Haley suggests raising the retirement age, which — as you’ve pointed out — is effectively a way to cut Social Security benefits. How can you be so confident?

A. Ron who? Nikki who? Mike who? Rick Who? The people you mentioned, the forces who have been in favor of privatizing Social Security, have lost every step of the way.

The person who put his heart and soul into it, who ideologically believed in it, was George Bush. He went to 17 cities in 72 days and every time he spoke the popularity of privatizing Social Security fell. By the time it came up for a vote in the first year of his second term, no Democrat broke ranks. The whole Democratic Party voted against it. Since George Bush, the Democratic Party has been in favor of putting more money into Social Security and they’ve stopped the conversation about cutting benefits. A big part of the Republic Party — the growing part, the popular part — has been in favor of Social Security. Donald Trump has never uttered a sentence that disparages Social Security or Medicare. The group you mentioned has lost.

Q. Are high student loan balances among younger workers today going to lead to a worsening of the retirement income crisis tomorrow?

A. Yes. My best graduate student right now is looking at the long reach of student debt on retirement savings and we are finding evidence that, over time, student debt does pinch retirement savings security for some. For many people, though, it only helps.

The people with the highest amount of student debt are the people who have finished their degrees, and those people now have higher paying jobs. People with higher debt are more likely to have higher paying jobs with retirement plans so in fact their debt grew them into higher retirement savings.

My brother had a huge amount of student debt because after 15 years of being a fire fighter he went to medical school. So he shows up in the statics, but he’s fine. High student debt is correlated with high retirement security.

You have to take out the people with low levels of student debt who never finished their degrees. For those people, it crushes them for the rest of their lives.

Q. Are there best practices we could borrow from other nations?

A. Yes! I was the moderator for a group of 20 people, representatives of their national pension systems, at a big conference in Boston last fall. They were the usual suspects: the Dutch, the Australians, the Brazilians, the Indonesians, the British, the Scandinavian countries. We used the Mercer/Melbourne report that ranks the best pension systems in the world.

Finland always gets top marks. They get an A+ for efficiency, equity, adequacy, and integrity, and have for 20 years. Finland has a mandated advance-funded system on top of their social security system. Everybody’s in it, and the rich get as much benefit from it as the poor.

The Finish guy said they’re the best because they’ve ignored all the advice from all the economists — especially the Americans. We don’t let people manage their money, we don’t cut benefits, we don’t means test, and we don’t let people take money out before retirement. Then, we pay an annuity until the end of their lives. That goes against all of your advice. He was actually rather smug.

Q. Were the French right to protest the (ultimately successful) attempts to increase their retirement age from 62 to 64 by 2030?

A. Every time the French people protest against their government I have a headline. They expressed what all workers in G7, G11, G20 countries know, which is that bodies break down after a lifetime of work, and a pension system that relies on older people to patch up a broken retirement system with more years of work is one of the most risky proposition you can provide to a person. It’s hard to get a job, no matter what country you’re in, when you’re over 62. It’s hard to keep your skills up to date in a fast moving, vibrant capitalist system. At that point you have very few options.

The young can stop buying avocado toast (note: laughter breaks out). The young have a lot of things on their side, but mainly time. By the time you’re 62, everything is just kind of probable. It’s not possible and there’s no potential. It’s just all predicted. There’s no wonder they went out into the streets at great risk despite everything the government was putting up against them. Every single government — that’s the theme of my book, as you know — that believes that “working longer” is a cheap and free solution to their retirement crisis is wrong.

# # #